Client Protection

Advans Pakistan is committed to providing clients with quality, adapted financial services and excellent customer service.

Client Protection Principles

Advans Pakistan is committed towards creating a culture of fairness in customer dealing and has therefore developed a Client Protection Principles that clearly states the management views and the protocols that need to be followed to ensure it is also in line with SBP’s Fair Treatment of Customers (FTC).

As part of Advans Group’s vision to provide clients with quality services, all Advans Group subsidiaries are Smart Campaign endorsers since 2011 and aim to comply with all Client Protection Principles (CPP).

Client Protection Principles is a basic model, which identifies the factors that can contribute to achieving adequate levels of satisfaction and protection that characterizes the relationship between consumer and financial entity and is necessary for creating a fair market infrastructure where:

- Consumers make informed financial decisions

- Have confidence in the banking industry

- Understand and exercise their rights and

- Have effective recourse for their grievances

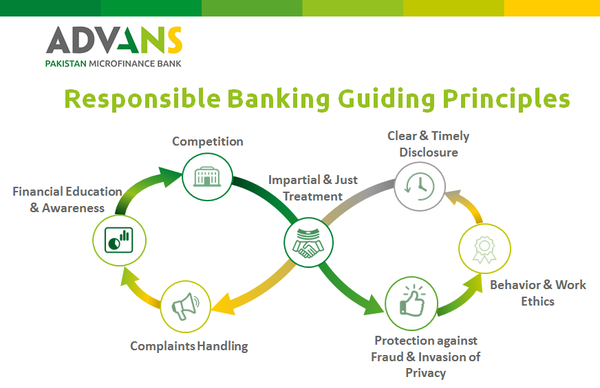

Guiding Principles

Appropriate Product Design and Delivery

Advans Pakistan’s products aim to respond to specific client needs. Methods for developing new products include: (i) market surveys, information meetings and focus group discussions to determine and validate the requirements of customers; (ii) definition of product specifications to design appropriate features and pricing; (iii) prototype tests and focus groups where clients are able to give feedback on the proposed product (iv) product development and; (v) pilot tests before the launch of new products to ensure that the product is behaving the right way; (vi) staff training on product features and delivery; and (vii) go live. It also ensure that clients understand the terms and conditions for new products through offering information sessions in both national and local languages before clients take out a loan or when a new product is introduced.

Prevention of Over-Indebtedness

Advans Pakistan’s loan methodologies are based on cash flow analysis, looking at the income and expenses of each client, and are designed to ensure that loans fit the client’s needs and can easily be repaid. Advans Pakistan work with other banks and credit bureaus to share information on their loan portfolio and therefore help to build a professional microfinance industry and fight against over-indebtedness. All client officers are provided with thorough training on how to assess clients’ repayment capacity and trained on repayment capacity policies and procedures. Loan appraisal and credit bureau checking procedures are repeated with any new loan application.

Transparency

Advans Pakistan aim to clearly display product features and tariffs in branches, on leaflets and on contracts or on their websites and ensure that there are no hidden costs. When possible, information sessions are delivered to clients in both official and local languages.

Responsible Pricing

Pricing for any given loan is calculated based on: i) competitor prices and ii) the cost of funds of the institution and what is needed to achieve sustainability. Advans Pakistan also aim to offer fair returns on deposits. Any change in pricing is communicated to clients.

Fair and Respectful Treatment of Clients

Branch staff receive introductory and regular refresher training on respect of clients and correct conduct and are closely monitored throughout the network in order to ensure that clients receive quality customer service. A Whistleblowing procedure is in place to ensure that any inappropriate conduct is flagged up and reported to management.

Privacy of Client Data

All client information is kept confidential and is only disclosed to third parties when required by law or regulatory authority. Data is kept in confidential files or on secure online databases. If credit bureaus are in place, clients are made aware during the loan application procedure that their details will be sent to the credit bureau. Consent of clients is always requested before featuring them in communication materials.

Mechanisms for Complaint Resolution

To ensure that clients are satisfied with the services provided, several different methods have been put in place for clients to make complaints or give feedback. Mechanisms in place include dedicated phone numbers, email addresses and suggestion boxes. These complaints are reviewed by a member of the institution’s commercial or operational team and dealt with according to the level of urgency of the complaint.